FINANCIAL HIGHLIGHTS

REVENUE

Rs 8.4Billion

Group revenue for FY2025 increased substantially by Rs 3.2 billion, from Rs 5.1 billion to Rs 8.4 billion, an uptick of 64.1%. Bazalt Réunion contributed Rs 2.7 billion to total revenue. However, even without this contribution, our Mauritian operations, led by the stellar performance of UBP and Premix, delivered solid results, adding Rs 544 million in revenue, an increase of 10.6% over FY2024.

EARNINGS PER SHARE

Rs 8.15

+9.5% VS 2024

SHARE PRICE ............

SHARE PRICE

Rs 78.00

-9.3% VS 2024

-39.3% SINCE 5 YEARS

DIVIDED PER SHARE 2025

Rs 1.75

Rs 1.75 FOR 2024

AVERAGE DIVIDEND PAYOUT RATIO

37.3%

OVER THE PAST 5 YEARS

COMPOUND AVERAGE ANNUAL TOTAL SHAREHOLDERS RETURN OVER THE PAST 5 YEARS

-7.4%

COMPOUND AVERAGE ANNUAL GROWTH RATE OF SHARE PRICE OVER THE PAST 5 YEARS

-9.5%

CHAIRPERSON'S STATEMENT

BALANCING GROWTH IN A REGIONAL LANDSCAPE

As we entered financial year 2025, the Group stood as a newly regionalised entity, operating within two markedly different economic environments. In Mauritius, the context was shaped by rising labour costs, including an imposed 14th-month salary and significant wage increases, set against a backdrop of political transition. Despite initial uncertainty, the construction sector flourished with the start of major public infrastructure projects alongside the New Social Living Developments (NSLD) project, which together fueled demand and activity across the sector.

In Reunion Island, the economic slowdown was pronounced, underscoring the cyclical nature of our industry and adding complexity to this first year of consolidation. Yet, the Group delivered strong results, reinforcing our confidence in the strategic direction we have taken. For me, the recovery of our core business and Bazalt Réunion’s outstanding performance have been the defining features of the year. The acquisition has proven transformational, generating profitability in its first year and positively reshaping the Group’s profile.

GROUP CEO'S INTERVIEW

HOW DID 2025 UNFOLD FOR THE GROUP? WHAT STANDS OUT MOST TO YOU?

2025 marked an important step in our evolution – our first full year operating as a truly regional Group following the integration of Bazalt Réunion. With that came increased scale, but also the need for greater coordination and responsibility in the way we operate. I am proud to share that we delivered on both fronts.

Despite facing a demanding environment, from rising labour costs in Mauritius, a slowdown in Reunion Island, and a more constrained cash position following our recent acquisition, we achieved strong growth in revenue and profitability. The improvements we have seen this year, whether in performance, in pace, or in cohesion, reflect the steady transformation we have been driving over the past few years. We have improved coordination, defined roles more clearly, and sharpened visibility across all our operations. And while these changes may not produce immediate results, they are moving the needle in meaningful ways and helping us build a more focused, disciplined way of working.

Behind these numbers lies the effort of every single individual within the Group who has stepped up and is fully committed to their role. To me, this reflects the culture we’ve built, where each person understands the value of their contribution to the bigger picture, and consistently gives their best to help us grow stronger.

GROUP CFO'S REPORT

PERFORMANCE OVERVIEW

FY2025 was marked by growth and consolidation for UBP, as our strategy to strengthen our position both locally and regionally continued to bear fruit. The Group’s major segments were boosted by government projects in social housing and infrastructure, in which UBP played an important role, making a solid contribution to our overall performance for the year. Both UBP and Premix delivered exemplary results; however, the construction sector remained under pressure as material and shipping costs continued to rise and global events caused supply chain delays. The shortage of skilled labour in Mauritius also persisted, particularly in our retail segment. (See “Operating Environment”, pg. 22, for more information.)

We are particularly proud to announce that, despite a difficult operating environment, Group revenue increased substantially by Rs 3.2 billion, from Rs 5.1 billion to Rs 8.4 billion, an uptick of 64.1%. Bazalt Reunion contributed Rs 2.7 billion to total revenue. However, even without this contribution, our Mauritian operations, led by the stellar performance of UBP and Premix, delivered solid results, adding Rs 544 million in revenue, an increase of 10.6% over FY2024.

The upsurge in revenue was reflected in our operating profit, which more than doubled from Rs 330.8 million in FY2024 to Rs 694.3 million in FY2025, of which Rs 288.3 million originated from Bazalt Réunion and Rs 61.5 million from an exceptional gain realised on the disposal of investment properties.

DIVISIONAL REVIEW

The United Basalt Products Limited

Contribution to the Group

Our entity is a significant contributor to the Group’s overall performance locally, providing 54.7% of the Building Materials cluster revenue. We play a crucial strategic role within the Group as we supply other Group companies with the raw materials they need for their production and for reselling. The revenue generated from our aggregate and block activities enables the Group to make strategic investments and fuel its growth over time. We also offer a competitive advantage to our intra-group customers by being the main supplier of aggregates, strengthening the UBP Building Materials value chain.

Premix Ltd

Contribution to the Group

Premix plays a crucial role in UBP’s overall strategy and performance. As concrete is a major end user of aggregates, our projects contribute significantly to the consumption of UBP’s products. Furthermore, our ability to secure customers often leads to potential business for the other entities in the Building Materials cluster, since construction projects require concrete, blocks, rocksand and other materials. This vertical integration creates tangible synergies within the Group, leading to collaborations on projects such as the Phoenix-Beaux Songes Link Road, a major infrastructure project in Mauritius which used both UBP aggregates and Premix concrete.

Drymix Ltd

Contribution to the Group

Not only is Drymix one of UBP’s top three customers for rocksand, we leverage group synergies through joint cement procurement. Historically, Group companies functioned independently of each other. However, since the establishment of the Building Materials cluster, we have begun to work together strategically to negotiate with suppliers, resulting in more favourable pricing for higher-volume purchases. Efforts are ongoing to further improve teamwork and integration across the cluster. Furthermore, Drymix operates a subsidiary in Reunion Island. Our products are exported to both Reunion Island and Mayotte.

Espace Masion Ltée

Contribution to the Group

Espace Maison has always been a significant contributor to the Group’s overall performance and a key component of the strategy. We represent about 16.0% of the total revenue of the Group. Over the past decade, we have more than doubled our revenue and established a strong brand and consumer image. By providing the finishings needed after construction, our products and services complement those of other subsidiaries in the Group.

Compagnie de Gros Cailloux Limitée

Contribution to the Group

Gros Cailloux embodies the Group’s ambition to move beyond its traditional activities by diversifying revenue streams and enhancing its sustainability profile through initiatives like our compost project (see Sustainability Report, page 68). Our relationship with Espace Maison is mutually beneficial; we produced 390,000 plants for sale through Espace Maison outlets, representing 71% of our nursery sales. We unlock land value appreciation and create opportunities for future strategic development. Internally, collaboration initiatives such as “Mo Bizin Twa” (“I need you” in English) have broken down silos and strengthened solidarity, embedding agility and inclusiveness into our company culture.

SAS Bazalt Réunion

Contribution to the Group

The acquisition of Bazalt Réunion as from July 2024 has added a new dimension to the Group’s portfolio. Beyond extending our regional footprint, Bazalt Réunion brings distinctive technologies, industrial processes and know-how that differ from those relevant to our activities in Mauritius. For example, the quarrying and aggregates production processes in Reunion Island allow for deeper extraction, producing materials of a different quality, while precast offerings are broader and more technologically advanced. This extends our value proposition and diversifies our capabilities. Anzemberg on the other hand adds specialised expertise, broadening the overall scope of services and reinforcing our position as a comprehensive regional provider.

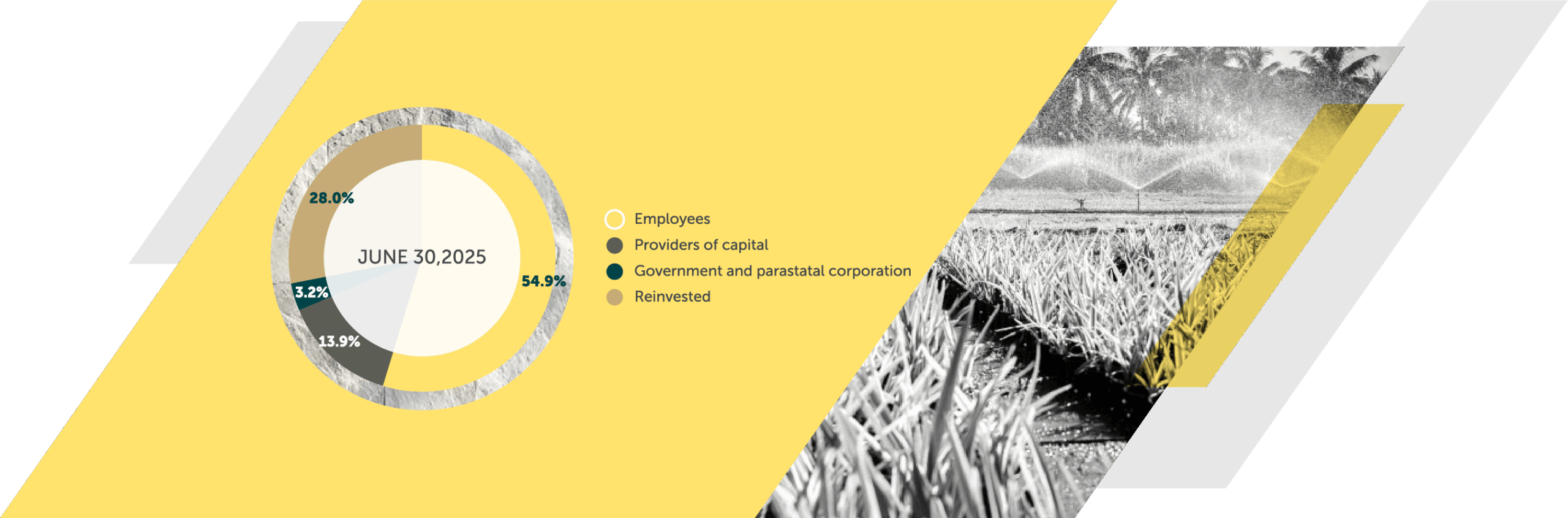

VALUE ADDED STATEMENT

SUSTAINABILITY REPORT

TRANSFORMATION AND INNOVATION

At UBP, we recognise that, as a major player in a resource-intensive industry, we have a dual responsibility to provide the materials needed to create the built environment – to the highest quality and safety standards – and to do so with due regard for our impact on the environment, on the communities we serve, and on our employees. The extraction and crushing of basaltic rocks to produce aggregates and their by-products have environmental consequences that need to be managed and mitigated.

To ensure the Group is “future ready” and able to anticipate these challenges and transform them into opportunities, the Transformation and Innovation (T&I) Office was set up in May 2024.

The key action areas of the T&I Office comprise three activities: Sustainability; Innovation with a focus on ‘R&DD’ (Recherche et Développement Durable); and Digital Technologies to optimise the use of resources. The Office is developing a framework to instil an innovation culture into operational units and drive change within the Group.

HUMAN CAPITAL

Our people are central to our ability to create long-term value. As a Group, we strive to ensure that every employee feels part of a unified vision, regardless of their division, role or location. Guided by our values — integrity, engagement and innovation — we are fostering a cohesive workforce that can deliver on our transformation agenda while remaining firmly anchored in shared purpose.

TRANSFORMATION AND INNOVATION

At UBP, we recognise that, as a major player in a resource-intensive industry, we have a dual responsibility to provide the materials needed to create the built environment – to the highest quality and safety standards – and to do so with due regard for our impact on the environment, on the communities we serve, and on our employees. The extraction and crushing of basaltic rocks to produce aggregates and their by-products have environmental consequences that need to be managed and mitigated.

To ensure the Group is “future ready” and able to anticipate these challenges and transform them into opportunities, the Transformation and Innovation (T&I) Office was set up in May 2024.

The key action areas of the T&I Office comprise three activities: Sustainability; Innovation with a focus on ‘R&DD’ (Recherche et Développement Durable); and Digital Technologies to optimise the use of resources. The Office is developing a framework to instil an innovation culture into operational units and drive change within the Group.

HUMAN CAPITAL

Our people are central to our ability to create long-term value. As a Group, we strive to ensure that every employee feels part of a unified vision, regardless of their division, role or location. Guided by our values — integrity, engagement and innovation — we are fostering a cohesive workforce that can deliver on our transformation agenda while remaining firmly anchored in shared purpose.

Dear Shareholders,

The Board of Directors of The United Basalt Products Limited (the ‘Board’) is pleased to present the Integrated Report of the Company for the year ended June 30, 2025 (the ‘Report’). This Report was approved by the Board on September 25, 2025.

FORWARD-LOOKING STATEMENTS

This report contains certain forward-looking statements regarding the results and operations of the Group which, by their nature, involve risk and uncertainty, because they depend on circumstances that may or may not occur in the future. Although forward-looking statements contained in this presentation are based upon what management believes are reasonable assumptions, undue reliance should not be placed on them.

JEAN-CLAUDE BÉGA

CHAIRPERSON

Developed by The Loud Group